Shrimpy Review: Is It The Best Cryptocurrency Management Platform For Traders?

Recently, a lot of cryptocurrency portfolio management tools have been invented. Such tools make it easy for the user to manage their cryptocurrency assets from any cryptocurrency exchange and reach financial goals. One of such a tool most commonly used features is Automated trading. Let’s discuss Shrimpy, a cryptocurrency trading bot that claims to have mastery in managing multiple user accounts using different cryptocurrency exchanges.

Automated Trading requires users to use various crypto trading bots and software. This Shrimpy review will answer all the questions about what it is and how traders can use it for different use cases.

What Is Shrimpy?

Shrimpy.io is the best crypto trading bot offering features like social trading, portfolio management, long term portfolio Management growth. It was incepted in 2018 when the Shrimpy team decided to build a platform for traders to manage and grow their portfolios through different strategies.

With Shrimpy, traders can create a tailor-made strategy across various cryptocurrency exchanges and use it along with their traditional trading strategies. Shrimpy offers some unique features that help it stand out from its competitors.

Shrimpy- At A Glance

| Information | Shrimpy |

|---|---|

| Logo |  |

| Headquarters | Santa Clara, California |

| Rating | 4.5/5 |

| Features | Easy to use, Social trading, and Affordable plans are available |

| Available Plans | Starter, Professional, Enterprise |

| Supported Exchanges | 17+ |

| Listed Cryptocurrency | ETH, ADA, DOGE, BTC, etc |

| Trading Fee | None |

| Is Legit? | A legitimate and trustworthy company |

| Official Site | https://www.shrimpy.io/ |

How Does Shrimpy Work?

Shrimpy has two major concepts on which it works.

- Rebalancing the portfolio

- Diversification of the crypto assets

Any trader can decide their allocations and use one of these concepts for managing their portfolio. When a trader chooses the portfolio rebalancing, the Shrimpy algorithm optimizes the portfolio by increasing the potential returns by 53% and reducing the volatility. This strategy is fully backtested and used for different financial instruments like bonds and stocks.

Also, when a trader chooses different crypto assets, they can use a simple dashboard to enter the amount or percentage of the crypto tokens they want in their portfolio. The Shrimpy will automatically calculate the rates and trading fee to offer you the best portfolio at an optimum price.

Shrimpy: Features

Shrimpy offers a variety of features that helps it to stand out from different competitors. Some of the widely used features are the following.

Indexing Tool

Shrimpy has one of the best indexing tools for the crypto markets. Traders can create an index on Shrimpy with an easy-to-use User interface. Also, any developer can create API keys and use features such as indexing strategy, rebalancing, etc.

Portfolio Rebalancing

Shrimpy focuses on individual portfolio management through simple automation of elements such as stop loss, dollar cost average, and rebalancing. With one click, traders can copy the lead traders’ strategy and portfolio holdings.

Backtesting

Any trader who sets up the custom trading strategies can now do backtesting and tweak it further for improvements. With the Shrimpy backtesting feature, traders can test any strategy and index the historical data to understand how the strategy would have performed on old data.

Social Trading

Social Trading allows traders to copy the trading strategy of famous traders on Shrimpy. There is a facility where traders can follow other fellow traders and use their process by simply copying it. Beginner-level traders can access the trading strategies from the dashboard. Also, Based on the number of copies, the trading strategy can help traders earn up to 4 dollars for every copy.

Shrimpy: Pricing Plans

There are different plans available on Shrimpy. You can use any plan to automate your portfolio management based on your needs.

? Starter

Cost: 15 USD per Month

This plan is for the new traders who have just begun to invest. Some of the features it offers are the following:

✔ Spot trading

✔ Three portfolios per crypto exchange account

✔ Portfolio tracking

✔ Strategy backtesting

✔ Social Trading

?Professional

Cost: 63 USD per month

Professional traders can avail of this plan to control their portfolios completely. Some of the features available are the following.

✔ API Access

✔ Manage ten cryptocurrency exchanges account

✔ 5 min balance refresh

✔ Five portfolios per exchange account

?Enterprise

Cost: 299 USD per Month

Enterprise-level companies managing different cryptocurrency portfolios can subscribe to this plan. There are some unique features that one can avail.

✔ Priority Support

✔ Ten portfolios per exchange account

✔ Connects with up to 25 cryptocurrency exchanges

✔ 1 min balance refresh

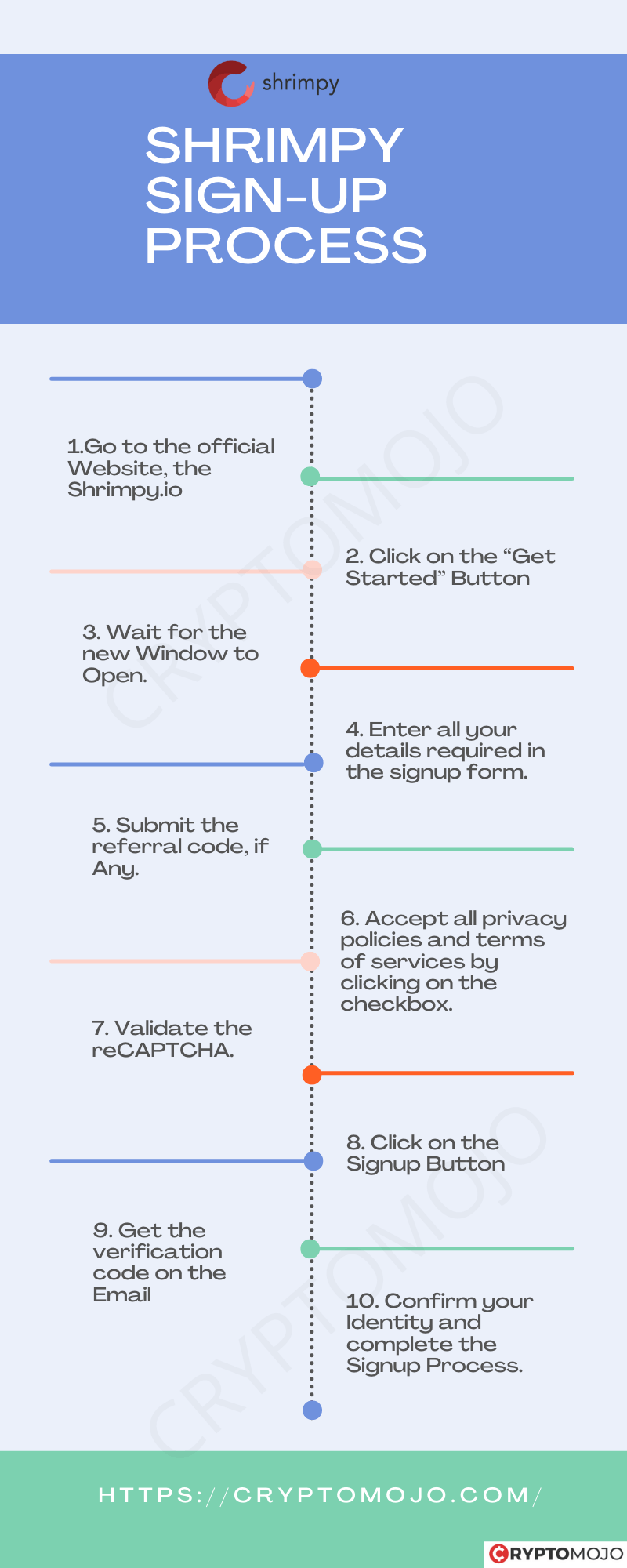

Shrimpy: How To Signup?

Anyone can create an account on Shrimpy through a quick and straightforward process. Traders must provide a valid email address and password to sign up on Shrimpy.io.

The Shrimpy Signup process is following.

Shrimpy: Available Exchanges

Some of the cryptocurrency Exchanges it supports are the following:

Bibox, Binance, Binance US, BitFinex, BitStamp, Bittrex,Bittrex Global, Cex.io, Coinbase Pro, FTX, FTX US, Gate.io, Gemini, HitBTC, Huobi Global , Kraken, KuCoin, OK, Ploniex

Wallet Supported are the following:

1 Inch Wallet, Coinomi, Elliptical, Guarda, Huobi Wallet, JulWallet, Ledger Live, Metamask, Rainbow, Spatium, ToknPocket, Unstoppable, SafePal

Shrimpy: Fee

On Shrimpy, the trading fee can range from USD 1 to USD 1000. There are different levels of fees charged to the users discussed below.

1. Premium Leader Fees

Premium leader fees are the additional fee charged by different leaders. Every leader has a facility to charge a fee for different strategies that they implement and people follow. This fee is charged on Shirmpy every month. Two Premium trading fees are Asset Under Management Fee and Flat Dollar Fee. Premium Leader fee is the additional fee on top of the Subscription Cost.

2. AUM (Assets Under Management) Fees

Asset Under Management (AUM) is the sum of the funds managed under a leader. It is calculated by adding the value of every portfolio that follows the leader’s trading strategy. Like the Premium Leader fee, it is charged every month. Every Follower needs to pay at least a percentage of their portfolio to the leader.

3. Performance Fee

It is determined by the profits followers of a leader make. Consequently, leaders receive a higher share of traders’ earnings if they profit more.

4. Flat Dollar Fees

A flat Dollar Fee is a fee for the trader who follows a leader. It charged for each portfolio to which copied strategy is Applied. If any trader follows a leader with a monthly fee of $5 for two accounts, then the trader must pay USD 10 for both accounts.

Shrimpy: Pros & Cons

Pros

- There are some features like crypto bots available for free.

- Top Notch Security and a variety of trading tools

- Allows traders to copy trading strategies and duplicate the profitable ones

- Automatic Rebalancing through Automation

- A lot of Educational Material on Cryptocurrencies And Investments

- Easy to Use

- Supports a variety of Cryptocurrency Exchanges and manages a portfolio

- Demo Account available for the beginners

- Threshold Rebalancing and Dollar Cost Averaging

Cons

- No mobile App for traders

- No trading bot scripting facility

- No trading Terminal

- Limited validity on Referral Program

- Doesn’t offer 100 percent Security

- Do not provide crypto signals

Trading APIs:Shrimpy

There are numerous APIs offered by Shrimpy that help developers to execute various transactions on different exchanges and do activities like intelligent order routing, limit orders, and support market orders. The orders placed through Developer APIs are precise and quick. Some of the commonly used APIs are:

✔Smart Order Routing API

A Smart Order Routing API helps traders to optimize the trading process. Developers can specify the assets that they want to buy through Limit or Market order. Based on that, the platform will evaluate the best possible routes for the trade and offer the best market price to the developers.

✔ Trading API

Trading API helps traders trade using their different portfolios. It allows traders to place an order, be it a market or Limit order.

✔ Historical Data API

Historical APIs are helpful to get the patterns and trends followed in the past. Sometimes, this allows the traders to make huge profits. Also, developers can build investment strategies to execute trades and enhance their portfolios.

✔ Live Data API

With a Live Data API, traders can make a viable decision. This API offers multiple endpoints to get complete information about the latest market data. Two ways to use APIs are through Rest API Endpoints and WebScookets. Traders and Developers can use such APIs in various mobile APplication and implement it with different strategies like threshold rebalancing and much more.

Shrimpy: Ease Of Use

Shrimpy was developed by keeping beginners as a primary audience, people who are not experts or do not want to put much time into cryptocurrency trading. And, all the features are designed to fulfill the basic needs more intuitively and in a more straightforward manner. Shrimpy is a Web Application. Hence, it can be easily accessed without following any complex installation process on different devices.

Security: Shrimpy

Shrimpy follows top-notch security measures and uses some secured servers like HTTPS. Also, there is an option of two-factor authentication(2FA). All the trades are conducted on the exchanges rather than through App APIs. Also, it is recommended not to withdraw funds through app API.

Shrimpy: Alternatives

Shrimpy alternatives are the best cryptocurrency exchanges, crypto portfolio management apps, trackers, and Stock trading Applications. Some of the alternatives are listed below.

✔ Good Crypto

It is one of the 30 most significant cryptocurrency exchanges available as a mobile application for both IOS, Android, and web applications. Some primary tools it offers are trade automation, intelligent alerts, and automatic portfolio tracking.

✔ BitUniverse

It is a complete end-to-end solution to manage the crypto portfolio. There is also a crypto trading bot to automate things. Some advantages are free of cost and an easy-to-use user interface.

✔ HaasOnline

It is an empowering crypto trading bot for the traders to enhance their profit returns and conduct trade efficiently without any errors

✔ WunderTrading

The platform offers social Trading, portfolio management, and crypto trading services.

Final Verdict On Shrimpy

Shrimpy is the best platform for cryptocurrency traders looking for an intuitive and straightforward way to manage their portfolios. As discussed above, Shrimpy Users can create an unlimited number of API keys to connect to any cryptocurrency exchange it supports. One user can connect different accounts from the same cryptocurrency exchange. Shrimpy will Fulfill all your needs when it comes to automated trading.

Frequently Asked Questions

Shrimpy uses advanced tools for managing its APIs. All the information is validated and protected through API keys. Also, it offers a 2FA option to access the accounts.

Yes, Trading Bots like Shrimpy are fully Legal. Shrimpy is considered to be the safest trading bot in the market.

The APIs are available for automating and managing the Shirmpy Account. As a developer, you can use Shrimpy APIs to integrate different features such as automatic Trading. There is a rate limit of 60 requests a minute.

Shrimpy Rebalancing tool allows the traders to enhance their ROI. They can quickly sell overperformed assets and buy underperforming assets using the sell high and buy low strategy.

Some features are free but based on your needs, you can buy any of the plans among beginner, Intermediate, and Enterprise level plans. Every plan costs differently.