Best Crypto Tax Software Australia – Top Picks 2022

Hello everyone today we will be discussing some of the best crypto tax software Australia that helps you record your crypto transactions on your tax return.

Investing in cryptocurrencies can be rewarding, but it is essential to realize that there is a difference between investing in cryptocurrencies and other forms of investment that you may be more familiar with (such as forex and stocks).

Best Crypto Tax Software Australia – Do They Really Help?

The Australian Taxation Authority (ATO) has applied existing laws to cryptocurrency transactions in a counterintuitive manner.

But with some guidelines, it is possible to understand the Australian crypto tax. Ultimately, different tax liabilities may arise depending on the transaction type and the entity conducting the trade

Read this article till the end to know about the best crypto tax software Australia and how they help you on your crypto tax return.

Key Points To Look Out For In Best CryptoTax Software Australia?

The most important 5 things that can be very useful in your Australian cryptocurrency tax now

ATO Crypto Rules

Australia is once again a lucky country with a tax authority issuing clear guidelines on crypto taxation. The rules keep changing throughout the country so we should appreciate where we are in Australia.

Everything is covered in the ATO, but the content remains dry in the classic form of government.

Australian Cryptocurrency Tax Guide

Under this guide, you will learn about everything, including the latest ATO requirements and detailed directions for the taxation of cryptocurrencies in various scenarios, such as crypto.

Online Accounting Services

It can be very boring to sit with an accountant and work when filing your tax returns. We can combine cryptocurrency statements with the newest tax services to have a way to go. You can also submit all your documents to the ATO myTax portal.

It is one of the best methods to fly yourself. We can also take advantage of guided DIY services like H&R Block, Etax, and Online Tax Australia. This paid service allows you to pay taxes online using your desktop or mobile while providing direction and assistance.

Crypto Tax Records and Reports

Tracking every crypto trade and the value of the Australian dollar at the time of purchase or release is a massive problem with many opportunities for error. Preserve your records by keeping them securely connected to your wallets and exchanges

FOR Early Engagement Teams

There are many people who are still not sure about how cryptocurrencies are taxed or classified.

Merchants with unique tax issues are dependent upon the ATO. An early engagement call can be put up by anyone who needs advice on a complex transaction.

What Is Crypto Tax Software Australia?

If you feel that crypto taxes are complicated then a crypto tax calculator can be your savior. The software tends to connect to crypto exchanges to make it easy to record your crypto transactions on your tax return.

Settling an account with the IRS during taxation can be quite difficult if you have traded cryptocurrencies extensively.

Unlike stockbrokers, even the best crypto exchanges don’t always have to file a tax form summarizing your annual activity. Find out what you earned last year and what that means for your taxes.

Several software companies have developed products over the past few years to help investors and traders prepare for tax filings on Bitcoin and other cryptocurrencies. Typically, these programs use data from your exchange to record your gains and losses.

Is Cryptocurrency Taxed In Australia?

Yes, as per the latest news Crypto is taxed in Australia. Suppose you wish to join the up to 1 million Australians who have invested in Bitcoin and other cryptocurrencies

People have to make clear that they will be taxed on any profit that they make on Crypto. Those jumping ahead of the unprecedented 2021 rally will be pleased with some significant gains.

Still, the recent crash – which has seen Bitcoin drop more than 50 percent since November last year – offers exciting prospects for new investors.

You have to be very thorough with every document and fine statement while making any investments. The tax obligations should also be kept in mind while buying, selling, and investing in cryptocurrencies.

How Does Australia Tax Cryptocurrency?

Do you pay taxes on cryptocurrencies? Yes. Capital gain tax and income tax apply to crypto in Australia as it is considered a worthy investment.

Since the ATO focuses specifically on cryptocurrencies, it is essential to understand the tax implications of owning cryptocurrencies.

The Australian government does not refer to or accept bitcoin and other cryptocurrencies as foreign currency or currency. Your tax depends on your “intentions” and attitude. Go for the best crypto tax calculator Australia today for calculating your tax liabilities.

What Is Crypto Tax Software Australia?

The Crypto market has proved its worth to all the investors out there as they have made millions of dollars of profits from these digital currencies. But with advantages come tax obligations, and understanding cryptocurrency taxes is not as easy as it seems.

For saving your time and reducing the chances of human error creeping into your annual crypto tax, here are some of the best crypto tax software Australia.

Koinly: Best Free Crypto Tax Software Australia

Koinly is a cryptocurrency-focused tax reporting app that will help you understand all the taxes related to your cryptocurrency activities and can even help you learn how to save money on those tax obligations.

Cryptocurrency laws and regulations seem to change every month, so it’s essential to make sure you have a little extra help to stay compliant with your cryptocurrency.

Pros

- Koinly works in more than 20 different tax jurisdictions

- Several levels are available with additional costs

- Free app version available

- Support advanced use cases of cryptocurrencies such as betting and decentralized finance

- It supports 6,000+ cryptocurrencies and 350 exchanges

Cons

- Expensive for frequent traders

- Generally more costly than other options on the market

- The free plan doesn’t support many features

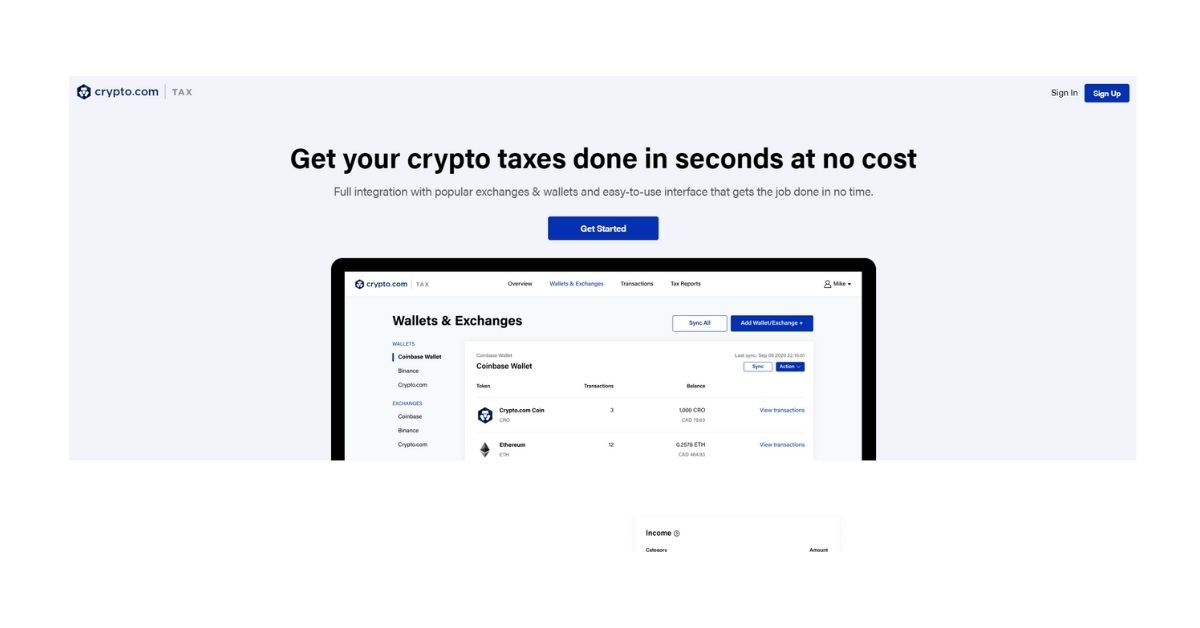

Crypto.com: Cheapest Crypto Tax Calculator Australia

If you are looking for a cheap, all-in-one cryptocurrency taxation platform, Crypto.com might be for you.

With Crypto.com you can calculate all your crypto tax in one place without the need to go through different guidelines and that too within seconds.

Its vast API support, interactive and easy-to-use UI, and free-to-use tools make it an ideal choice for those users who are not willing to start with a paid tax software solution.

Pros

- Low cost

- Good for crypto payments

- Easy money conversion

- Visa card with cashback price

- Earn interest on cryptocurrency

Cons

- Difficult to navigate

- Coins are not available everywhere

- Bad customer service

- Lack of educational resources

CryptoTrader: Overall Best Australian Crypto Tax Calculator

CryptoTrader comes next in our list of best crypto tax software Australia, this software is a platform that provides one of the best algorithms for trading Bitcoin and other cryptocurrencies without custody.

One of the key highlights of CryptoTrader is its advanced crypto tax software solutions that come with advanced features such as free rapport preview and international tax support.

CryptoTrader is also a TurboTax partner and the collaboration adds an additional layer to its credibility.

Easy exporting, one-click rapport download and a wide range of crypto platform support make CryptoTrader one of the finest crypto tax software in the market.

Pros

- Easy to register

- lots of suggestions

- have the best tax liability calculations

- provide accurate reports

- Provide tax loss collection

Cons

- Average customer support

- The interface is complicated

BearTax: Fastest Crypto Tax Calculator Australia

Bear Tax is an online platform that offers a cryptocurrency portfolio tracking service to determine your total profit and loss. This makes it a hassle-free process for filing your annual tax return.

Bear Tax does this through an innovative algorithm based on an API that connects to your chosen cryptocurrency exchange.

These include, for example, Binance, Gemini, KuCoin, Coinbase – and many more.

Pros

- Cheap crypto tax solution available for $10 per year

- Get help from an accountant for just $200 a year

- Tools for accountants who process taxes for their clients

- Integrated with traditional tax reporting software

- Get a discount for buying two years of Crypto Tax Help at once

Cons

- Decentralized finance is not available as an option

- It also does not work as a crypto portfolio tracker

- The concise discount period

ZenLedger: Best Australian Crypto Tax Software For Tax Professionals

As Bitcoin and the crypto space have become more attractive, it has also become much more complex.

ZenLedger is built for crypto traders and tax professionals who need a way to simplify the crypto tax reporting process during the new wave of decentralized finance (Defi).

Like other trackers on the market, ZenLedger integrates with various cryptocurrency exchanges and networks to provide complete coverage for traders operating in this volatile market.

Pros

- Strong support for Defi apps

- TurboTax Integration

- Free option for new crypto-traders

- Additional tax specialist support is available

- Premium customer support available to all users

Cons

- Initial support through professional tax assistance is expensive

- The transaction limit Is too low for the free plan

BitcoinTax: Best For Low Transaction Volume

This crypto tax calculator Australia focuses on simplifying the understanding of tax in crypto for businesses and individuals.

BitcoinTax strives to simplify and unify the entire process by making all files, documents and reports easily accessible via one electronic platform. Available with personalized access for businesses and consumers.

BitcoinTax makes it easy to upload and view real-time cryptocurrency data and connects seamlessly to 100+ cryptocurrency exchanges.

BitcoinTax offers additional features such as tracking analysis, audit trail analysis, and capital loss claim and is developed by industry insiders (CPAs and tax attorneys), making the Software much more accurate and reputable.

Pros

- There are responsive and supportive customer service representatives

- Offers a free trial

- This dramatically simplifies the crypto tax filing process

- It gives you a constant audit trail

- Facilitate issue 1099 for exchange

Cons

- Limited options for automatic synchronization and reporting

- Don’t store a lot of cryptocurrencies

TokenTax: Best Crypto Tax Calculator With CPA Support

TokenTax is another best crypto tax software Australia you can trust to process your taxes. This tool gives you the ability to extract a solid selection of crypto tax reports from your spreadsheet, including IRS Form 8949.

It will also help you with your cryptocurrency income taxes, cryptocurrency audits, and international profit/loss reports. Like many of the other solutions on this list, it can also help collect tax losses and offer support for margin trading.

Pros

- Easy-to-use control software

- Support multiple exchanges

- International support

- Tax-loss collection tool available

Cons

- The base plan does not have several functions

- No free trial

How Does Crypto Tax Software Australia Work?

Crypto tax software Australia helps you file tax returns with the IRS. Programs ordinarily sync with trades and crypto wallets to follow your buys, deals, and different exchanges.

Most crypto charge programming will send out the different structures you really want during tax collection, saving you the time and bother of following all your crypto exchanges and finishing up IRS shapes physically.

Most crypto programming charges an expense to assist with getting ready assessments.

The sum as a rule relies upon the number of crypto exchanges you make in one fiscal year.

You ought to expect a capital addition or misfortune at whatever point you purchase, sell, or exchange cryptographic forms of money.

Likewise, with different speculations burdened by the IRS, your benefits can be short or long haul, contingent upon the residency you held the cryptographic money prior to selling or trading it.

What Features Should I Look For In Best Crypto Tax Software Australia?

There are many tax software available in the market so people face problems when choosing from so many available options.

Some software targets state income tax returns, while others help you file your federal tax return.

You should always have an idea before you take the route. Before you get help filing taxes, ask the following questions about your ability to purchase tax software.

Price

Most online tax software providers have multiple plans at tiered pricing so the cost will depend on your needs.

Each software option has its features and pricing structures, so you need to determine what features you need to compare products accurately.

The cheaper option may suit your needs, but the software is usually more expensive if you need more advanced features.

Tax Harvesting Functionality

Long-term equity gains are taxed at 10%. Tax collection is a technique that reduces this impact.

Accidents happen even with the most comprehensive tax software. Having a professional by your side who can look at taxes can be very useful in case anything goes wrong.

Several reputable companies offer tax preparation services included with the total purchase or available as an add-on.

Technical Support and Customer Service

The quality and availability of technical support and customer service are essential to being the best crypto tax software Australia.

When things go wrong, you want reliable, supportive, and forthcoming employees who can meet your needs.

Familiarize yourself with the company you are considering before making a final decision

Seamless Imports

It has been proposed to divide cryptocurrency exchanges into three categories: businesses that act as intermediaries, brokerage services that enable buying and selling, and trading platforms that provide trading interfaces.

They may need to be registered under GST and collect TCS. One of the significant characteristics of a tax software application is the type of forms that can be submitted. Make sure the format you need is saved.

Is Crypto Tax Software Australia Safe?

The quantity of individuals putting resources into digital currencies is expanding quickly and consistently.

This is on the grounds that it can make you a tycoon or even an extremely rich person rapidly. History is evidence of that.

Be that as it may, with regards to paying charges on the exchanges you make in digital forms of money, it very well may be an overwhelming interaction. You will probably make several transactions in a year being an investor in cryptocurrency.

Capturing these transactions and then calculating the net profit and loss is impossible for everyone.

When they choose Crypto Tax software, people think of their security there. Then, to clarify, crypto tax software is very secure, and you should use it.

Is Crypto Tax Software Free?

Crypto tax software Is the trend in today’s world. Most of us Want to use it but think about whether it’s free or paid.

Many crypto tax software provides free services, while some provide paid services. Free crypto Tax software Provides Some basic features, while paid Software offers premium features.

What Happens If You Don’t Report Cryptocurrency On Taxes?

If you fail to report taxable cryptocurrency and face an IRS audit, you could face interest, fines, or criminal prosecution.

This could be seen as tax evasion or fraud, said David Canedo, a Milwaukee-based CPA and product manager for Tax Specialist at Accounting, a cryptocurrency tracking, and reporting tool.

While the odds of the IRS being audited are lower with a limited staff, the agency may be after a more significant amount of money, he said.

How Do You Avoid Crypto Tax?

You can get a tax exemption if you hold cryptocurrency as an asset for personal use. If you don’t buy more than AU$10,000 cryptocurrency to purchase something else directly with cryptocurrency, you are eligible for this exemption even for a short time.

On the off chance that a digital currency is procured and held for quite a while before the exchange is made, or then again if by some stroke of good luck a minuscule piece of the cryptographic money is utilized to make a specific exchange, the digital money is probably not going to turn into a resource for individual use.

Cryptocurrencies are unlikely to be assets for personal use in the following situations:

- If you need to exchange cryptocurrency for Austrian dollars or other cryptocurrencies to purchase personal consumer goods, or

- Another payment method if you don’t want to get involved with Crypto directly.

Best Crypto Tax Software Australia – Final Thoughts

It may seem surprising to think back on the many cryptocurrency home transactions you can make during the 2021 pandemic lockdown.

Rest assured that enterprising tax professionals have created crypto tax software to handle it for you and comply with the IRS – drafting regulations. It’s hard enough to pay your taxes properly when it’s easy.

As a cryptocurrency and irreplaceable token (NFT) trader, you may find changes to tax regulations in dangerous places.

As of March 2022, there is no consensus on how cryptocurrencies, NFTs, crypto interest, and other DeFi assets should be taxed.

Your best protection is tax preparation software configured for decentralized finance (DeFi), crypto, and NFT traders.

Hope this article on the best crypto tax software Australia gave you an overall idea about the top crypto tax calculating software available in Australia.