9 Best Decentralized Crypto Exchanges Australia: Top DEXs in Australia 2022 Ranked

Welcome readers. This post will take stock of the best Decentralized crypto exchanges Australia that offer you unmatched security and anonymity.

DEX or Decentralized exchanges are independent of centralized authority. Therefore, no third party is needed to make the transactions. Many believe that it represents the true idea behind cryptocurrencies. The authority remains in the hands of users and not with any centralized players.

Users remain anonymous while making the trade, their funds remain secure with them, and there is a negligible possibility of hacking or theft.

Best Decentralized Crypto Exchanges Australia: Top Picks 2022

Top DEX in Australia offers similar ease of use and functionality as that of a centralized exchange. Moreover, each DEX is unique, has its own proprietary features, and offers several ways to multiply your investment.

If we have piqued your interest, below is a carefully curated list of the Best DEX in Australia. We have handpicked the best Decentralized crypto exchanges Australia based on several criteria, including ease of use, features, fees, etc.

- Uniswap

- Bisq

- Kyber Network

- 0x Protocol

- Airswap

- Balancer

- Shapeshift

- Shapeshift

- Idex

What Are Decentralized Crypto Exchanges Australia?

Since the cryptocurrency frenzy began, countless crypto-assets trading platforms have sprung up—all competing to have the largest chunk of the market.

But in their quest to capture the biggest user base, they have all diverted from the core philosophy of cryptocurrencies: decentralization.

Even the top crypto exchanges in Australia, like Binance, Coinbase, KuCoin, etc., are all centralized. Incidentally, centralized exchanges are subject to the will of their owners, and to use them; you have to entrust your money to them.

DEX or Decentralized exchange preserves the essence of decentralization and remains free from controlling authorities. DEX offers you a platform where you can buy, sell or trade cryptocurrencies without any regulation or supervision of a centralized entity. You can have the peace of mind that no third party has control over your assets.

How Do Decentralized Exchanges Work?

The idea of decentralized exchange does seem lucrative, but how does it manifest on the ground? The answer is simple – via peer-to-peer interactions.

DEX allows the trading of digital assets through direct transactions validated by smart contracts. This eliminates the need for a third party to supervise the transaction or the exchange. Consequently, users make peer-to-peer (P2P) transactions via a secure online platform without resorting to intermediaries.

In a centralized exchange, intermediaries ensure the execution and safety of transactions between the interaction parties. DEX, on the other hand, brings blockchain as the middle man. In short, smart contracts take over the role of intermediaries and oversee all the intermediation work.

What To Look For In A Decentralized Exchange

While DEXs do appear to preserve the essence of cryptocurrencies, there’s a whole host of technicalities they have to overcome for wider adoption of the DEX platform. In case you are considering onboarding a DEX platform for your crypto dealing, here are some pointers you should check out to ensure easy adoption;

Available Assets To Trade

Everyone is obviously entering the crypto world for profits. A vast selection of available coins allows a higher possibility of making big profits. Traders love to have multiple choices; therefore, a DEX platform that entertains a vast selection of coins should be a better choice.

Ease-of-use

DEX operates in a manner different from a traditional centralized exchange. Therefore users are often in blue about how to navigate the interface. UI is the first thing we notice and therefore plays a decisive role when choosing a platform. DEXs, unfortunately, still lack the simplicity of CEXs. Moreover, peer-to-peer dealing also complicates the process; therefore, a DEX platform that emphasizes simplicity should be the first choice.

Security

Despite all the promises of high security, the DEX platforms still have to ensure the safety of private keys. If the DEX platform is unable to prevent the leak of private keys during the operation, you are exposed to similar risks as that of trading of CEXs. Therefore, security is undeniably an essential criterion to look at while choosing a decentralized exchange.

Best Decentralized Crypto Exchanges Australia Reviewed

DEXs are in good numbers, and it is often confusing to choose the best one. To facilitate our users and help avoid pitfalls, we will tell you the best Decentralized crypto exchanges Australia. To curate the list, we deeply analyzed several aspects such as security, fees, features, number of coins available as well as ease of use keeping in view the needs and priorities of Australian Users.

Here are the top DEX in Australia;

| Exchange | Launch Year | Currencies | Supported Cryptocurrencies | Fees |

| Uniswap | 2018 | 185+ | 0.3% | |

| Bisq | 2014 | 11+ | 0.7% | |

| Kyber Network | 2017 | 118+ | 0.10% | |

| 0x Protocol | 2016 | 310+ | 0 | |

| Airswap | 2017 | 280+ | 0 | |

| Balancer | 2020 | 100+ | 1% | |

| Shapeshift | 2014 | 60+ | varies | |

| Changelly | 2013 | 100 | 0.5% | |

| Idex | 2017 | ERC20 token | 0.2% |

Uniswap

When it comes to DEX, Uniswap is undeniably the king and therefore occupies the top slot in our list of best DEX in Australia. Although riddled with several obstacles since its inception, Uniswap has always recovered effectively, and the ample liquidity and simplicity of the platform always make up for the inconveniences. Founded in 2018 by Hayden Adams, Uniswap has been ruling the DEX space.

To ensure proper functioning, Uniswap relies on liquidity providers. These are the users who are willing to deposit their cryptocurrencies in the liquidity pools to allow exchanges. This way, Uniswap has aggregated countless numbers of pools, allowing you to trade almost any ERC-20.

As far as the charges are concerned, Uniswap charges a 0.3% trading fee on each token swap. Moreover, yield farmers also get a share of the charges recovered depending on the contribution.

Pros

- No KYC process, which makes it a completely decentralized exchange.

- A simple interface that facilitates novice crypto traders.

- Staking is possible and offers lucrative returns.

- Open source and completely transparent.

- Support for ERC 20 tokens.

Cons

- No support for fiat currency complicates the onboarding process.

- Higher gas fees make it an expensive choice.

Bisq

Bisq is a Barcelona-based crypto DEX originally intended to facilitate Bitcoin trades. Bisq was born in 2014, making it one of the oldest DEX platforms available right now. Similar to other DEX, Bisq ensures direct interaction between the trading party without committing the funds to the platforms.

One significant advantage of Bisq is it allows transactions via fiat currencies. Australian users who want to trade in AUD would particularly like this feature. However, it’s only a trading platform and does not offer other services like derivatives or margin trading.

Additionally, Bisq exchange allows you to trade around 37 cryptocurrencies, including all the big names like Ether, Dash, Litecoin, Monero etc.

As far as the fees are considered, they fall on the higher spectrum of the price range. You have to pay 0.001 BTC and 0.007 BTC as a manufacturer’s as well as a buyer’s fee. On top of that, there is an additional charge of 0.0003 BTC as a mining fee on each transaction.

Pros

- Allow transactions in fiat currencies.

- No verification is required.

- Several options are available to make payments.

- Simple interface.

- Arbitrators ensure the safe execution of transactions.

Cons

- Relatively expensive DEX platform.

- The basic interface lacks advanced features

Kyber Network

Kyber Network is another topper in our list of best Decentralized crypto exchanges Australia. This crypto exchange relies on smart contracts to facilitate token swaps on its platform. In order to provide a decentralized platform to its users, Kyber Exchange works as the liquidity protocol and raises funds from several pools.

This allows it to continue the exchange of tokens in a decentralized manner. Similar to Uniswap, the Kyber network relies on users to provide liquidity.

Moreover, unlike other decentralized platforms, the Kyber network provides instant token exchange.

However, you should note that currently, Kyber Swap does not work in complete anonymity. You have to get permission from the Kyber Network team to participate in a reserve. In this way, Kyber offers a unique and dedicated DEX platform compared to other exchanges.

Pros

- Allow immediate toke exchanges

- Liquidity is accessible via several methods like dApps, aggregators, etc.

- Completely transparent.

- Uses reserves instead of the order book to provide the best rates.

- Support numerous ERC20 tokens.

Cons

- The user interface lags in terms of functionality.

- Needs good reserves to guarantee maximum transactions.

0x Protocol

0x is a protocol that allows the development of decentralized exchange based on the Ethereum blockchain. The protocol introduces a new way of doing more secure and much cheaper transactions. The project was created in 2016 by Will Warren and Amir Bandeali.

The idea was to overcome the shortcomings of the traditional DEX platform, which is low performance due to transaction overload on the blockchain.

To overcome the issue, 0x created state channels that prevent blockchain load. It does so by exchanging cryptographically secure messages and writing only the final results on the blockchain. In addition, 0x crypto DEX does not charge any transaction fees, which is the main driving factor behind its success.

Pros

- Enjoys a good reputation which builds trust.

- Completely free and easily accessible.

- Registration and verification are not needed.

- Enables asset exchanges via smart contracts.

- Very fast and convenient.

Cons

- Functionality is only limited to ERC 20 tokens.

- It hasn’t gained traction despite attractive features and zero charges.

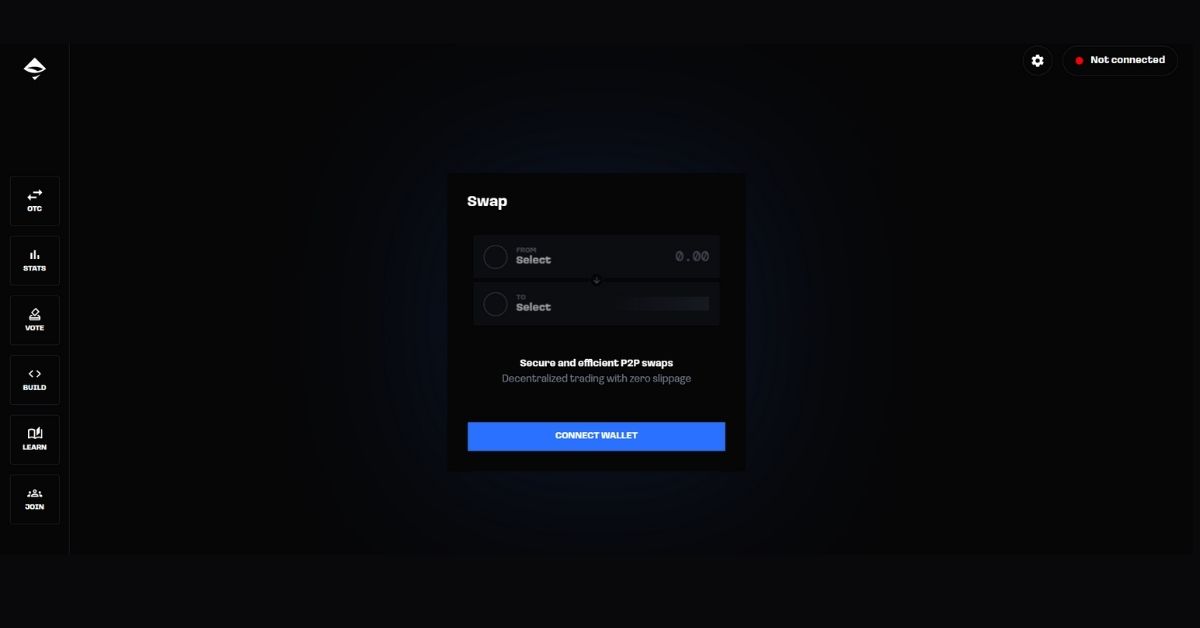

Airswap

AirSwap is another great decentralized exchange launched in 2017. Although the exchange is based in the USA, Australian users won’t have any issues while using the AirSwap DEX platform.

Similar to its cousins, Airswap also allows peer-to-peer transactions of cryptocurrencies and pairs. Right now, the exchange supports six coins and three pairs.

One particular attraction of Airswap is the zero trading fee; however, users can’t make deposits in fiat currencies.

Abiding by the core principle of DEX exchange, Airswap does not demand KYC or verification. It works on the Ethereum blockchain and allows users to swap cryptocurrencies via the unconventional route of direct interactions.

Pros

- High liquidity allows efficient transactions.

- No exchange fees.

- Implements several security measures to maximize safety.

- No account registration is required.

- Easy to use interface

Cons

- No support for Bitcoin.

- A limited number of token support.

Balancer

Balancer is another best DEX for Australian users. It’s a decentralized exchange that follows the AMM architecture. In simple words, similar to Uniswap, this platform also relies on liquidity pools.

The balancer was born in March 2020, and following its launch, it made the headlines due to the resounding success of its governance token, the BAL.

One thing that allows Balancer to stand out from other similar DEXs is its offering of multi-asset liquidity pools.

It means that unlike Uniswap, where the pools only contain two different assets, Balancer offers pools that contain up to eight different digital assets.

One interesting fact is that the exchange fees are set by the creator of the pool. As a result, there are no fixed charges; instead, the fees can vary from 0.0001 to 10%. However, practically speaking, the fees rarely exceed 1%.

Like Uniswap, Balancer, based on liquidity pools, accepts nearly all ERC-20 tokens. It’s only a matter of liquidity; if it’s there, trades are possible.

Pros

- Offer easy swapping of tokens without the need for centralized exchange.

- Offers advanced functionalities.

- Accept nearly all ERC 20 tokens.

- Support pools with up to eight different digital assets.

- The participants in the pool define exchange fees.

Cons

- Lacks helpful material to facilitate users easily understanding the working of the platform.

- Possibility of impairment losses.

Shapeshift

Faster and highly secure transactions are the specialty of shapeshift crypto DEX. Shapeshift was amongst the first platforms to kickstart the era of DEXs and was conceived in 2014.

Since its inception, Shapeshift has only grown in popularity, and today it’s a full-fledged DEX platform. You can buy your first coin via fiat money ( useful to make transactions in AUD) or swap cryptocurrencies using the simple to use Shapeshift dashboard.

On top of that, there is no shortage of digital assets to swap on Shapeshift. It supports all the major cryptocurrencies and altcoins.

It is a non-custodial exchange and easily links to hardware wallets such as Ledger and Trezor. Your private keys are secured with you, and you also don’t incur any charges while doing transactions on the Shapeshift platform hence making it one of the greatest among the best Decentralized crypto exchanges Australia

Pros

- Offer a convenient solution for crypto transactions.

- Zero exchange fees.

- Supports most of the stable coins.

- Has an app for both android and iOS.

- APIs to easily integrate with crypto wallets.

Cons

- Not completely transparent.

- Numerous incidents of transaction failures and lost funds.

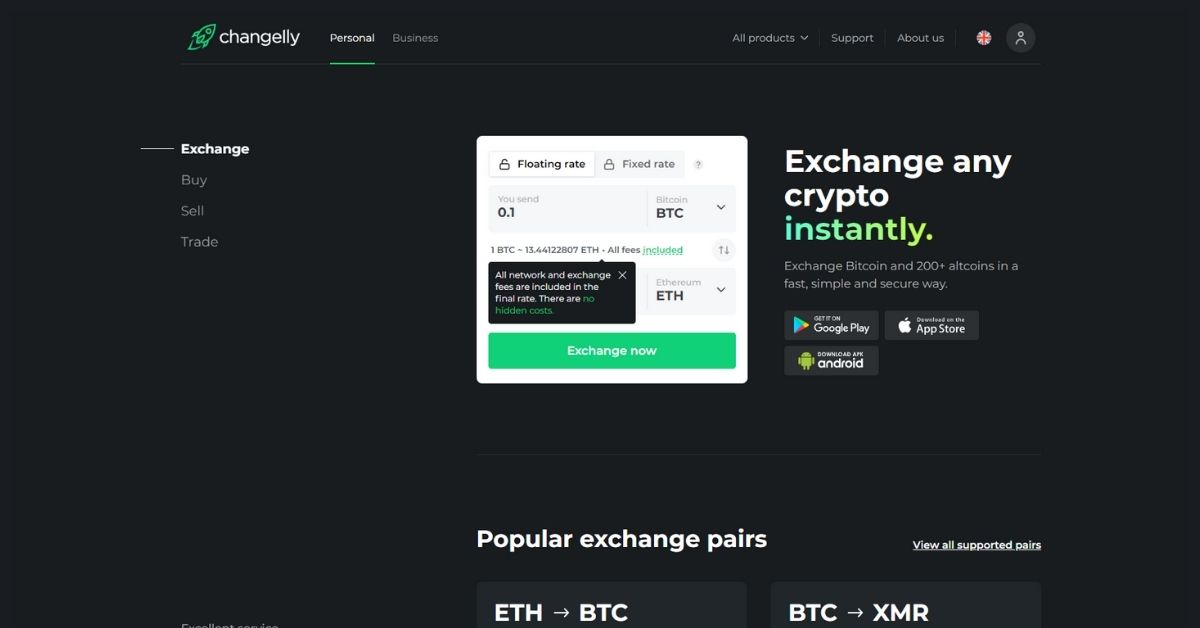

Changelly

Changelly was conceived way back in 2013 by the famous mining pool named Minergate. It’s a DEX platform and allows easy trading of cryptocurrencies without the hassle that’s common on trading exchanges.

Incidentally, you can exchange around 50 cryptocurrencies, including Bitcoin, Ether, Monero, etc.

Moreover, The user interface is sleek and easy to understand. The site even offers pictorial illustrations to guide users through various transactions. Even newbies will find navigating the Changelly dashboard extremely easy.

Unlike other exchanges on the list, Changelly charges a flat fee of 0.5% of the transaction amount for the exchange services it offers.

Pros

- Allow purchase via fiat currencies.

- Support nearly 200 cryptocurrencies.

- Competitive exchange fees.

- Simple and easy-to-use interface.

Cons

- Fiat to crypto is allowed, but rates are high.

- Payment options are pretty limited.

Idex

Idex is a relatively newer entrant in the DEX arena. It was launched in 2017 as part of the Aurora project, a finance and banking company comprising Ethereum-based applications and protocols.

It aims to provide ease similar to centralized exchange while maintaining the security and anonymity of DEX platforms.

Similar to other DEXs, Idex provides a peer-to-peer trading environment backed by smart contracts.

When it comes to supported coins, the Idex crypto exchange entertains nearly every ERC20 token. The list includes hundreds of tokens and continues to add more as it grows.

Fees on Idex are quite affordable. Makers have to pay a 0.1% maker fee while takers are charged 0.2% as a taker fee. Unlike other DEX platforms, IDEX implements a minimum order and withdrawal limit. The minimum order limit for takers and makers is $10 and $20, respectively.

Pros

- Faster crypto to crypto transactions.

- Encrypted transactions allow extra security.

- Staking is available to earn extra rewards.

- Integrates advanced features.

- Apart from the Ethereum blockchain, also available on Binance smart chain.

Cons

- Does not support Bitcoin trading.

- Liquidity is an issue that often remains sloppy.

Why Use a Decentralized Cryptocurrency Exchange?

CEX, or centralized exchange, goes against the spirit of cryptocurrencies, which DEX aims to preserve. It’s the biggest motivator for many to adopt decentralized exchanges. DEX operates in an open-source, trustless, and permissionless manner allowing users to have full transparency about their funds.

They also bring countless other benefits to the table. Here are some of the compelling reasons to use decentralized crypto exchanges;

Anonymity and Privacy

Best decentralized crypto exchanges Australia typically do not require private info while onboarding. In short, KYC is not necessary; therefore, all the operations on DEX remain anonymous, ensuring maximum privacy.

Self-Custody of Assets

DEX adheres to the principle of “your money you keep” and remains non-custodial, allowing users self-custody of their assets. In simple terms, users have full control over their private keys and therefore retain complete ownership of their assets.

Cheaper Transactions Fees

Decentralized crypto exchanges completely eliminate the middle man, resulting in much lower transaction fees. Moreover, crypto DEXs are also adopting innovative solutions to keep the fees negligible for end users.

Are Decentralized Exchanges Safe?

Decentralized exchanges are considered safer than their centralized counterparts. The primary reason is that users have control and ownership of their digital assets all the time. This eliminates the need for a centralized server with all the private keys stacked in it.

DEXs do not store their users’ assets and therefore leave the burden of finding the scattered entry points on hackers themselves; all the more reason for hackers not to attack it.

The possible avenues for breach are limited and, therefore, less exposed to hackers. Furthermore, smart contracts spread the information across nodes. It acts as an immutable record of information, and its distributed nature prevents denial of service attacks. All in all, DEX offers a much safer environment for crypto dealings.

Can Decentralized Exchanges Be Hacked?

Hackers indeed have a hard time hacking into DEX. The primary reason is the peer-to-peer transactions which do not allow an entry point to execute the hack. And most DEX uses smart contracts on an immutable blockchain network to process transactions in a peer-to-peer manner.

However, the possibility of hacking on the DEX exchange cannot be overruled. If hackers get their hand on your private keys, they can easily empty all your funds. A recent hack on Bancor, a DEX platform, was executed in a similar fashion.

Moreover, hackers can exploit vulnerabilities on DEX’s main website to carry out an attack. Wave, a popular DEX platform, was compromised in a similar way. Therefore, the possibility of a DEX getting hacked is negligible, but it’s not completely non-existent.

What Decentralized Exchange Can I Use To Buy Bitcoin?

If you are specifically interested in Bitcoins and want to execute the trade via a DEX in Australia, Bisq (formerly Bitsquare) is your best bet. Bisq is a decentralized exchange platform mainly focused on buying and selling bitcoins in traditional currencies. The best part is you can easily buy Bitcoin in AUD. Additionally, the platform also allows seamless exchange of bitcoin for alternative cryptocurrencies like monero.

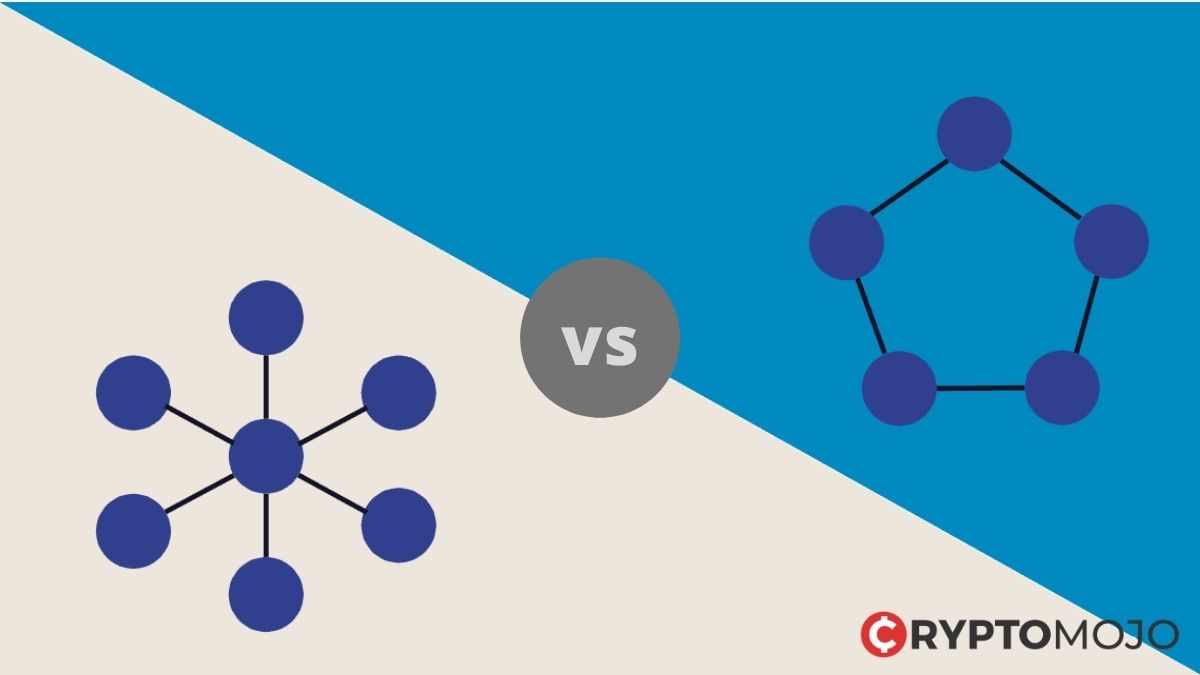

Decentralized Crypto Exchanges Vs Centralized Crypto Exchanges

CEXs and DEXs, each have their benefits and features. Centralized exchanges facilitate large-scale trading and bridge the gap between fiat currency and digital assets while acting as an intermediary to ensure proper safety and reliability of transactions.

On the other hand, DEX shuns the notion of authority and operates without the influence of any central regulating body. The main advantage of DEX over CEX is obvious – no intermediary is needed. Users have control over their funds, not a centralized platform.

Contrary to centralized exchanges, DEXs enables the decentralized exchange of assets, allowing inter-blockchain communication and direct transaction between two parties. All this while maintaining transparency, openness, and integrity.

On top of that, DEX also offers more robust security and complete anonymity to users. Unlike CEX, which often requires KYC, DEX does not demand to prove your Identity.

Similarly, CEX employs a central storage unit to store users’ information and asset details. In contrast, DEX acts in a non-custodial way and offers users complete control of their assets.

What Is The Most Popular Crypto Dex?

After extensive research, tests, and comparisons, we believe that Uniswap and Bisq are the best DEXs in Australia to trade cryptocurrencies.

Both of them excel in the most critical aspects: security, simplicity, and choice of assets.

While Bisq aims to be a one-stop solution for Bitcoin trading, Uniswap aims to be the leader of the DEX crypto trading platforms. To onboard a DEX and also to trade in a more serious way, Uniswap and Bisq are truly the best DEXs.

Also Read: 10 Best DeFi Wallets For Decentralized Finance In 2022

Best Decentralized Crypto Exchanges Australia – Conclusion

These are all the Best Decentralized crypto exchanges Australia that satisfied our selection criteria. Our best picks for top DEX in Australia are Uniswap and Bisq. While the former is known for user-friendliness and commitment to providing innovative solutions, the latter facilitates easy Bitcoin transactions in fiat currencies, which cover AUD too.

DEXs are becoming mainstream and remain faithful to the core idea of cryptocurrencies. However, you have to be extra careful about the security of your funds. There is no central authority that can provide you insurance against theft or breach.

If you are finding your way in the DeFi world and don’t know how to handle DEXs, it’s best not to try trading on decentralized exchanges until you are more adept with all the technicalities of the crypto world.